The world of cryptocurrency and blockchain is no longer a fringe interest; it's a burgeoning asset class capturing the attention of investors globally. But what happens when this digital frontier meets the established authority of governments? How are nations navigating the complexities of crypto portfolio diversification and its implications? The answers are as varied as the cryptocurrencies themselves, and they're evolving rapidly.

Navigating the intersection of digital assets and government regulation presents some difficulties. Businesses and individuals face uncertainty about compliance, taxation, and the overall legal landscape. This evolving environment makes it hard to strategically plan for the future.

This article delves into how governments worldwide, with a particular focus on Indonesia (ID), are responding to the growing trend of portfolio diversification in crypto and blockchain assets. We will explore different approaches, from outright bans to cautious regulation and even proactive adoption, examining the factors driving these decisions and the potential consequences for the crypto ecosystem. This is particularly relevant in Indonesia, a country with a large, tech-savvy population and a developing economy, where the potential for crypto adoption is significant, but regulatory clarity is still emerging.

Governments are taking diverse paths in response to the increasing integration of crypto and blockchain into investment portfolios. Some are implementing strict regulations, while others are fostering innovation through supportive frameworks. Key considerations include investor protection, financial stability, and the potential for economic growth. This article highlights various governmental strategies, aiming to provide clarity on this evolving landscape. Key words: cryptocurrency, blockchain, portfolio diversification, government regulation, Indonesia, digital assets, regulatory framework, investor protection.

Understanding Indonesia's Stance on Crypto

Indonesia has taken a unique approach to cryptocurrencies. I remember when I first started exploring blockchain technology; Indonesia seemed to be taking a relatively progressive stance, allowing crypto trading as commodities but prohibiting their use as a payment method. It was fascinating to observe this nuanced approach – acknowledging the investment potential while mitigating risks to the national currency. This duality reflects a broader trend among emerging economies: a desire to tap into the opportunities presented by digital assets while safeguarding financial stability.

Indonesia's government recognizes the interest in crypto investment. They allow crypto trading as commodities under the supervision of the Commodity Futures Trading Regulatory Agency (Bappebti). This approach reflects a desire to harness the potential benefits of crypto while minimizing risks. It’s an attempt to bring crypto activity into a regulated framework, providing some level of protection for investors.

Bappebti has been actively issuing regulations to govern crypto asset trading, exchanges, and custodians. These regulations aim to provide legal certainty and prevent illicit activities such as money laundering and terrorism financing. The goal is to create a safe and transparent environment for crypto investors in Indonesia.

However, cryptocurrencies are prohibited from being used as a means of payment in Indonesia. This is to protect the Indonesian Rupiah and maintain the central bank's control over monetary policy. This policy aims to prevent crypto from undermining the stability of the national currency and the financial system.

The Regulatory Spectrum: From Bans to Embraces

Governments' responses to crypto range from outright bans to embracing innovation. Some countries have imposed strict bans on cryptocurrencies, citing concerns about financial stability, money laundering, and investor protection. These bans typically prohibit crypto trading, mining, and other related activities, with the goal of eliminating crypto from the country's financial system.

Other countries have taken a more cautious approach, implementing regulations to govern crypto activities. These regulations may include requirements for crypto exchanges to register with the government, comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, and provide investor disclosures. The goal is to bring crypto activities into a regulated framework, providing some level of oversight and protection for investors.

A few countries have embraced crypto as a source of innovation and economic growth. These countries have created regulatory sandboxes to allow crypto companies to experiment with new products and services in a controlled environment. They have also enacted laws to clarify the legal status of crypto and provide tax guidance for crypto investors. The goal is to attract crypto businesses and investment, fostering a thriving crypto ecosystem.

A Historical Perspective on Crypto Regulation

The history of government responses to cryptocurrency is relatively short but eventful. In the early days of Bitcoin, many governments adopted a "wait and see" approach, unsure of how to classify and regulate this new technology. As crypto adoption grew, however, governments began to grapple with the challenges and opportunities presented by digital assets.

Some of the earliest regulatory actions focused on money laundering and terrorism financing. Governments recognized that crypto could be used to facilitate illicit activities and began implementing AML and KYC regulations for crypto exchanges and other businesses. These regulations aimed to prevent crypto from being used for criminal purposes and to increase transparency in the crypto ecosystem.

As crypto markets matured, governments also began to focus on investor protection. They recognized that many crypto investors were not aware of the risks associated with digital assets and that they could be vulnerable to fraud and scams. As a result, some governments have issued investor warnings and implemented regulations to protect investors from unfair or deceptive practices.

The evolution of crypto regulation is ongoing. Governments are constantly learning about the technology and its potential impacts, and they are adapting their policies accordingly. As crypto becomes more mainstream, it is likely that government regulation will become more sophisticated and comprehensive.

Unveiling the Hidden Secrets of Crypto Regulation

One of the hidden secrets of crypto regulation is the balancing act that governments must perform. They need to protect investors and the financial system from risks, but they also need to avoid stifling innovation and economic growth. This is a difficult task, as the crypto ecosystem is constantly evolving and new challenges are emerging.

Another secret is the importance of international cooperation. Crypto is a global phenomenon, and regulations in one country can have impacts on other countries. It is essential for governments to work together to develop consistent and coordinated approaches to crypto regulation. This can help to prevent regulatory arbitrage, where crypto businesses move to jurisdictions with more lenient regulations, and to ensure that crypto is not used for illicit activities.

A further secret is the role of technology in regulation. Governments can use blockchain technology and other tools to monitor crypto transactions, identify illicit activity, and enforce regulations. This can help to make regulation more efficient and effective. However, it is also important to ensure that these technologies are used in a way that protects privacy and civil liberties.

Ultimately, the success of crypto regulation will depend on governments' ability to understand the technology, balance competing interests, and adapt to a rapidly changing environment.

Recommendations for Navigating the Regulatory Landscape

Navigating the regulatory landscape for crypto requires a proactive and informed approach. Businesses and individuals should stay up-to-date on the latest regulations in their jurisdictions and in any jurisdictions where they operate. This includes understanding the requirements for registration, AML/KYC compliance, and investor disclosures.

It is also important to seek legal and tax advice from qualified professionals. Crypto regulation is complex, and it is essential to have expert guidance to ensure compliance and avoid potential penalties. Legal counsel can help businesses and individuals understand their obligations under the law and develop strategies to manage regulatory risk. Tax advisors can help with tax planning and compliance, ensuring that crypto transactions are properly reported and taxes are paid.

Furthermore, businesses should engage with regulators and policymakers to provide input on proposed regulations. This can help to ensure that regulations are practical, effective, and do not stifle innovation. By participating in the regulatory process, businesses can help to shape the future of crypto regulation and create a more favorable environment for the industry.

Finally, it is important to adopt a risk-based approach to compliance. This means focusing on the areas where the risks are highest and implementing controls to mitigate those risks. This can help to make compliance more efficient and effective, reducing the burden on businesses while still protecting investors and the financial system.

The Role of Central Banks in Crypto Regulation

Central banks play a crucial role in shaping the regulatory landscape for cryptocurrencies. As guardians of financial stability, they are concerned about the potential risks that crypto poses to the banking system and the broader economy. These risks include the potential for money laundering, terrorism financing, and the disruption of monetary policy.

Central banks are actively researching and experimenting with central bank digital currencies (CBDCs). CBDCs are digital forms of fiat currency issued by central banks. They could potentially offer a number of benefits, including increased efficiency, reduced costs, and greater financial inclusion. However, they also raise a number of challenges, including data privacy, cybersecurity, and the potential for disintermediation of the banking system.

In addition to CBDCs, central banks are also exploring the use of blockchain technology for other applications, such as cross-border payments and securities settlement. These applications could potentially improve the efficiency and transparency of financial markets. However, they also require careful consideration of regulatory and legal issues.

Ultimately, central banks will play a key role in determining the future of crypto regulation. Their decisions on CBDCs and other blockchain-related initiatives will have a significant impact on the development of the crypto ecosystem.

Tips for Investors Diversifying into Crypto

Diversifying into crypto can be an exciting opportunity, but it's crucial to approach it with caution and a well-thought-out strategy. Before investing, educate yourself thoroughly about the different types of cryptocurrencies, their underlying technologies, and the risks involved. Understanding the fundamentals of blockchain and crypto is essential for making informed investment decisions.

Start with a small percentage of your portfolio allocated to crypto. This allows you to gain experience and learn the ropes without putting too much of your capital at risk. As you become more comfortable with crypto investing, you can gradually increase your allocation.

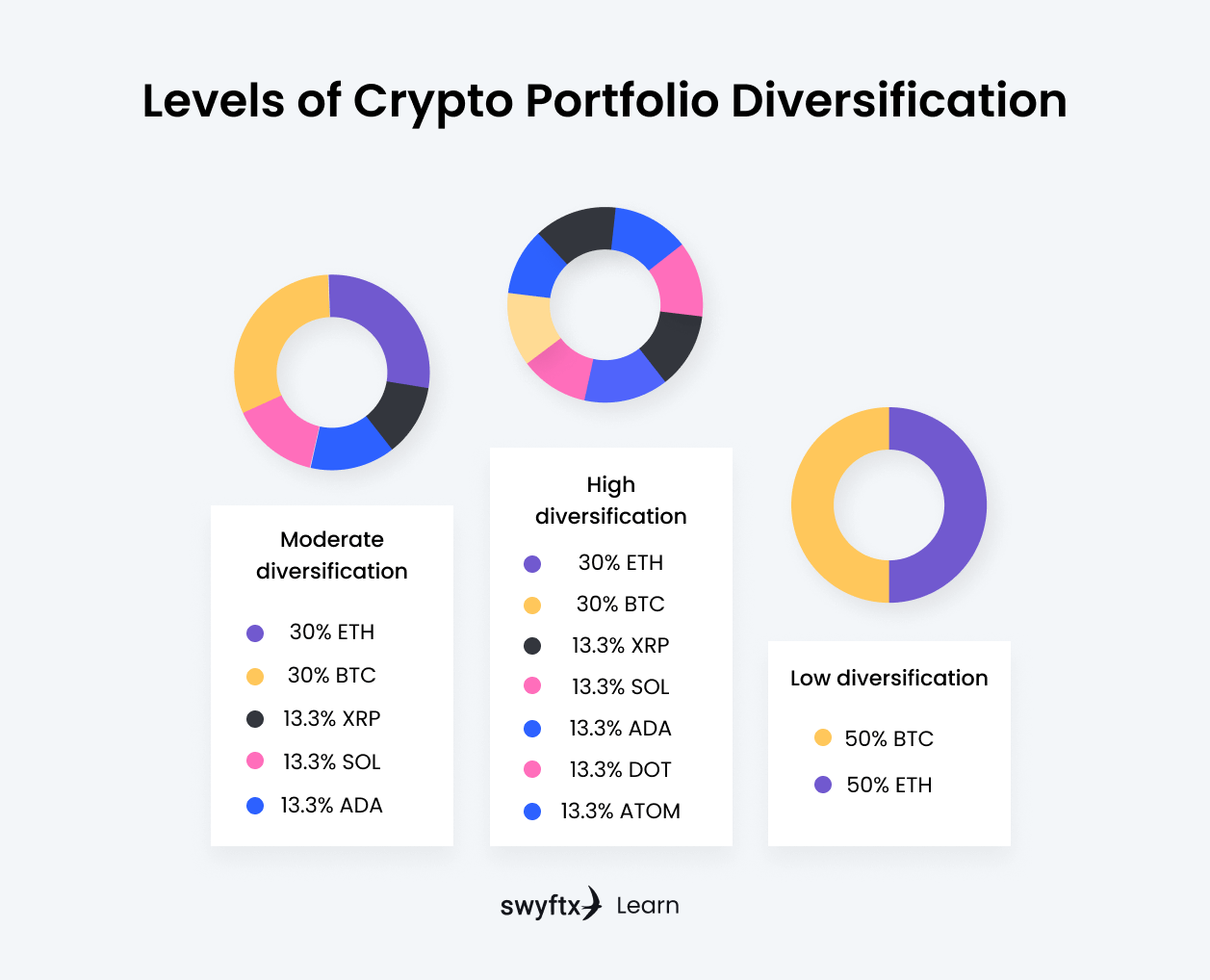

Diversify your crypto holdings across different cryptocurrencies and blockchain projects. Avoid putting all your eggs in one basket, as this can significantly increase your risk. Consider investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins with strong fundamentals.

Use reputable and secure crypto exchanges and wallets. Choose platforms with strong security measures, such as two-factor authentication and cold storage. This will help to protect your crypto holdings from theft and hacking.

The Impact of De Fi on Regulatory Frameworks

Decentralized Finance (De Fi) is a rapidly growing sector within the crypto ecosystem. De Fi platforms offer a range of financial services, such as lending, borrowing, and trading, without the need for intermediaries. This has the potential to disrupt traditional financial institutions and create new opportunities for innovation.

However, De Fi also presents a number of challenges for regulators. De Fi platforms are often decentralized and operate across multiple jurisdictions, making them difficult to regulate. They also raise concerns about money laundering, fraud, and systemic risk.

Regulators are grappling with how to regulate De Fi without stifling innovation. Some are considering applying existing financial regulations to De Fi platforms, while others are exploring new regulatory frameworks specifically designed for De Fi.

The regulation of De Fi is an ongoing process, and it is likely that there will be significant changes in the regulatory landscape in the coming years. Businesses and individuals involved in De Fi should stay up-to-date on the latest regulatory developments and seek legal and tax advice as needed.

Fun Facts About Government Involvement in Crypto

Did you know that some governments are actively holding Bitcoin? El Salvador, for example, has made Bitcoin legal tender and has been purchasing Bitcoin as part of its national reserves. This bold move has sparked debate and drawn attention to the potential for governments to embrace crypto as a store of value.

Another interesting fact is that some governments are using blockchain technology to improve public services. Estonia, for example, has been a pioneer in using blockchain for e-governance, including identity management, voting, and land registry.

It's also worth noting that some governments are issuing their own digital currencies. China is piloting a digital yuan, which could have significant implications for the global financial system. Other countries are also exploring the possibility of issuing CBDCs.

These examples illustrate the diverse ways in which governments are engaging with crypto and blockchain technology. While regulation remains a key focus, some governments are also exploring the potential benefits of these technologies for their own operations and economies.

Cara Engage with Government on Crypto Regulation

Engaging with government on crypto regulation is essential for shaping the future of the industry. Businesses and individuals can participate in the regulatory process in a number of ways. One way is to provide comments on proposed regulations. Governments often solicit public input on proposed regulations, and this is an opportunity to share your views and concerns.

Another way to engage with government is to meet with regulators and policymakers. This can be an effective way to educate them about the technology and its potential impacts. It can also help to build relationships and foster a dialogue between the industry and the government.

Furthermore, you can join industry associations and advocacy groups. These organizations represent the interests of the crypto industry and advocate for policies that support innovation and growth.

Finally, you can stay informed about regulatory developments and share your knowledge with others. This can help to raise awareness and promote a more informed discussion about crypto regulation.

Bagaimana jika Crypto Regulation Becomes Too Restrictive?

If crypto regulation becomes too restrictive, it could have a number of negative consequences. It could stifle innovation, drive businesses and investment to other jurisdictions, and limit the potential benefits of crypto for consumers and the economy. Excessive regulation could also make it more difficult for individuals to access crypto and use it for legitimate purposes.

In a scenario where regulation becomes overly restrictive, it is important for the industry to continue to advocate for policies that promote innovation and protect consumer interests. This includes working with regulators to develop regulations that are balanced and proportionate to the risks involved.

It is also important to explore alternative regulatory models, such as self-regulation and regulatory sandboxes. These models can provide a more flexible and adaptive approach to regulation, allowing innovation to flourish while still protecting consumers and the financial system.

Ultimately, the goal is to find a regulatory balance that allows crypto to reach its full potential while mitigating the risks involved.

Daftar tentang Key Considerations for Governments Regulating Crypto

1.Balance Innovation and Risk: Regulations should aim to mitigate risks like money laundering and investor protection, but without stifling innovation and economic growth.

2.International Cooperation: Crypto is global, so consistent and coordinated approaches are crucial to prevent regulatory arbitrage and ensure effective oversight.

3.Technological Expertise: Regulators need a deep understanding of blockchain and crypto to develop informed and effective regulations.

4.Clarity and Transparency: Regulations should be clear, transparent, and predictable to provide legal certainty for businesses and investors.

5.Flexibility and Adaptability: The crypto landscape is constantly evolving, so regulations should be flexible and adaptable to new technologies and business models.

6.Stakeholder Engagement: Governments should engage with industry participants, experts, and the public to gather input and ensure regulations are practical and effective.

7.Risk-Based Approach: Regulations should focus on the areas where the risks are highest, implementing controls to mitigate those risks.

8.Consumer Protection: Regulations should protect consumers from fraud, scams, and other unfair or deceptive practices.

9.Financial Stability: Regulations should aim to maintain the stability of the financial system and prevent crypto from undermining monetary policy.

10.Data Privacy: Regulations should protect the privacy of individuals and ensure that data is collected and used responsibly.

Pertanyaan dan Jawaban tentang Section About Governments Responding to Portfolio Diversification in Crypto and Blockchain Assets

Q: Why are governments so concerned about cryptocurrency?

A: Governments are concerned about crypto due to its potential for money laundering, terrorist financing, investor protection, and financial stability. The decentralized nature of crypto makes it difficult to track and regulate, posing challenges for law enforcement and financial regulators.

Q: What are some examples of different government approaches to crypto regulation?

A: Some governments have banned crypto outright, while others have implemented regulations to govern crypto activities, such as licensing requirements for exchanges and AML/KYC rules. A few governments have embraced crypto and are exploring its potential benefits, such as using blockchain for public services or issuing CBDCs.

Q: How can businesses and individuals stay up-to-date on crypto regulations?

A: Businesses and individuals should monitor regulatory developments in their jurisdictions and in any jurisdictions where they operate. They should also seek legal and tax advice from qualified professionals. Joining industry associations and advocacy groups can also help to stay informed.

Q: What is the role of international cooperation in crypto regulation?

A: International cooperation is essential for effective crypto regulation. Crypto is a global phenomenon, and regulations in one country can have impacts on other countries. It is important for governments to work together to develop consistent and coordinated approaches to regulation.

Kesimpulan tentang How Governments Are Responding to Portfolio Diversification in Crypto and Blockchain Assets

The journey of governments navigating the complex world of crypto and blockchain is far from over. While some countries are cautiously dipping their toes in, others are diving headfirst, and still others are choosing to stay on the sidelines. The key takeaway is that the regulatory landscape is fluid and constantly evolving. Staying informed, engaging with policymakers, and understanding the nuances of each jurisdiction are crucial for anyone involved in this transformative space, especially in a dynamic market like Indonesia. As crypto continues to mature, it's likely that we'll see more sophisticated and comprehensive regulations emerge, shaping the future of finance in ways we can only begin to imagine.