Imagine a world where transactions are transparent, secure, and lightning-fast, all thanks to a technology that's rapidly changing the landscape of investment. That technology is blockchain, and its potential is capturing the attention of experts across various industries. But what exactly do these experts foresee when it comes to the benefits of investing in blockchain? Let's dive in and explore the predictions that are shaping the future of finance and beyond.

Navigating the world of investment can often feel like traversing a minefield. Concerns about security, transparency, and efficiency are commonplace, leaving many investors feeling uncertain and hesitant. The traditional financial systems, while established, aren't without their flaws, leading to a desire for alternatives that address these fundamental issues.

Experts predict that blockchain investment will bring a multitude of benefits, primarily centered around increased security, transparency, and efficiency. They anticipate that blockchain technology will revolutionize industries beyond finance, impacting supply chain management, healthcare, voting systems, and more. This widespread adoption will create new investment opportunities and drive significant economic growth. Furthermore, blockchain's decentralized nature promises to democratize access to investment opportunities, empowering individuals and fostering financial inclusion.

The anticipated benefits of blockchain investment are multifaceted, including enhanced security through cryptography, increased transparency via distributed ledgers, and improved efficiency by automating processes and eliminating intermediaries. Its transformative potential across various industries, coupled with its ability to democratize access to investment, makes it a compelling area for future growth and innovation.

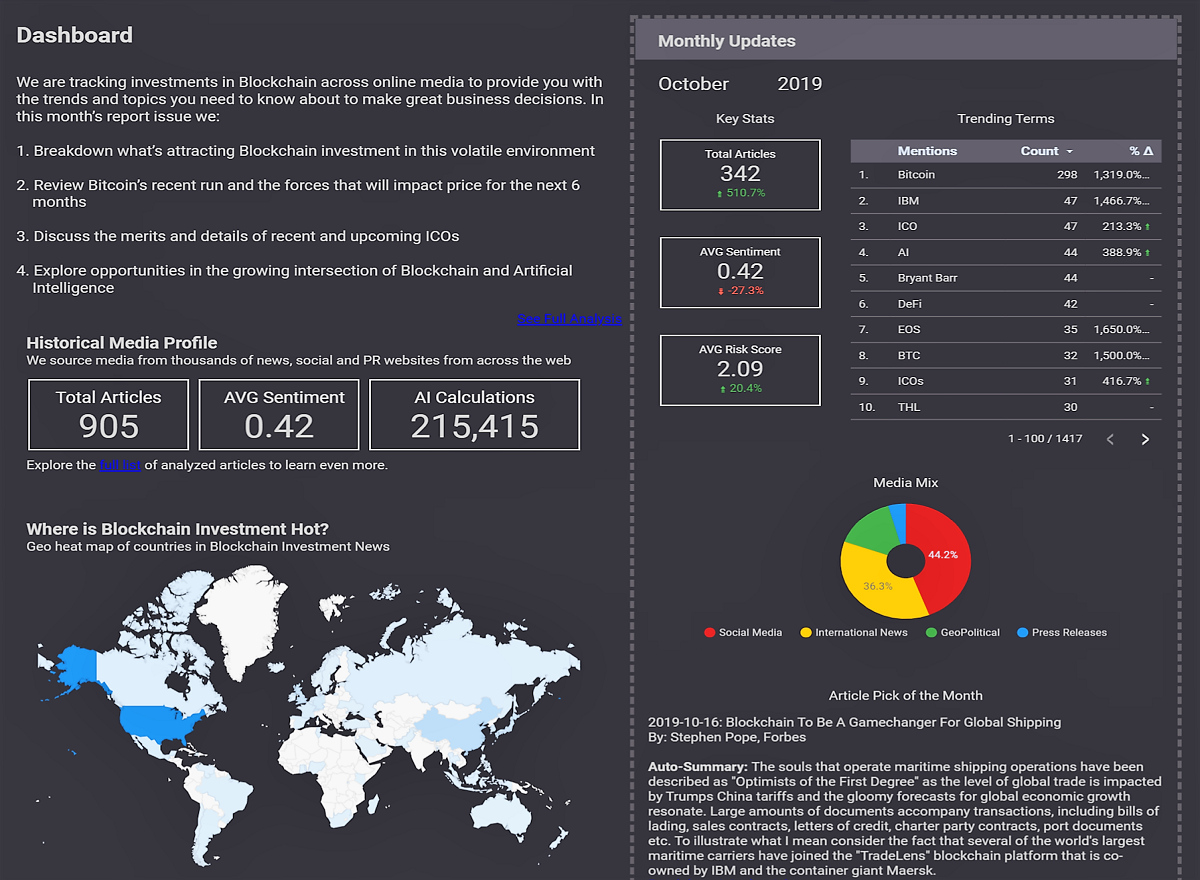

The Rise of Decentralized Finance (De Fi)

I remember first hearing about De Fi a few years ago, and honestly, I was skeptical. It sounded like a bunch of tech jargon with little real-world application. But as I dug deeper, I realized the potential was truly revolutionary. De Fi aims to recreate traditional financial systems – lending, borrowing, trading – but without the need for central authorities like banks. Everything is managed by smart contracts on the blockchain, creating a transparent and trustless environment. Experts predict that De Fi will continue to grow exponentially, offering investors new avenues for generating returns and participating in the financial ecosystem. One of the key benefits is accessibility. De Fi platforms often have lower barriers to entry compared to traditional finance, making it easier for individuals to participate, regardless of their location or financial status. Moreover, De Fi offers greater control over assets, as users retain custody of their funds. The potential for innovation within De Fi is also immense, with new protocols and applications constantly emerging.

Enhanced Security and Transparency

Blockchain's core strength lies in its inherent security and transparency. Unlike traditional databases, blockchain is decentralized and immutable, meaning that once a transaction is recorded, it cannot be altered or deleted. This makes it incredibly resistant to fraud and manipulation. Experts highlight that this enhanced security will be a major driver of blockchain adoption across various industries. In supply chain management, for instance, blockchain can track products from origin to consumer, ensuring authenticity and preventing counterfeiting. In healthcare, blockchain can securely store and manage patient data, improving privacy and interoperability. Furthermore, the transparency of blockchain allows for greater accountability and trust between parties. Every transaction is publicly visible on the distributed ledger, making it easier to audit and verify information. This transparency can help to reduce corruption and increase efficiency in various processes.

The Myth of Instant Riches

There's a common misconception that investing in blockchain is a guaranteed path to instant riches. While some early adopters have certainly seen significant returns, it's important to remember that blockchain investment, like any investment, carries risk. The market can be volatile, and there's always the potential for losses. The myth of instant riches often leads people to make rash decisions without proper research or understanding of the technology. Experts caution against this approach, emphasizing the need for due diligence and a long-term perspective. Blockchain is still a relatively young technology, and its full potential is yet to be realized. Investing in blockchain requires patience, a willingness to learn, and a realistic understanding of the risks involved. The history of technology is littered with examples of overhyped trends that ultimately failed to deliver on their promises. It's crucial to avoid falling into the trap of blindly following the hype and instead focus on the fundamentals of the technology and its long-term potential.

Unlocking Hidden Efficiencies

One of the often-overlooked benefits of blockchain investment is its potential to unlock hidden efficiencies across various industries. By automating processes, eliminating intermediaries, and reducing paperwork, blockchain can streamline operations and save businesses significant time and money. For example, in international trade, blockchain can simplify cross-border payments and reduce the need for complex documentation. In real estate, blockchain can facilitate faster and more transparent property transactions. Furthermore, blockchain can help to improve data management and reduce the risk of errors. By creating a single, shared source of truth, blockchain can eliminate the need for reconciliation and improve data accuracy. These hidden efficiencies can have a significant impact on a company's bottom line and make them more competitive in the global market. Experts predict that as more businesses adopt blockchain, these efficiencies will become increasingly apparent.

Recommendations for Investing in Blockchain

If you're considering investing in blockchain, experts recommend starting with education. It's crucial to understand the technology, its potential applications, and the risks involved. There are many resources available online, including articles, videos, and courses. Next, consider diversifying your portfolio. Don't put all your eggs in one basket. Spread your investments across different blockchain projects and asset classes to mitigate risk. It's also important to do your due diligence before investing in any project. Research the team behind the project, their business model, and their track record. Look for projects that have a clear use case and a strong community. Finally, be patient. Blockchain investment is a long-term game. Don't expect to get rich quick. Focus on the long-term potential of the technology and be prepared to ride out the volatility.

Understanding Blockchain Technology

At its core, blockchain is a distributed, decentralized, public ledger that records transactions across many computers. The "blocks" on the chain are linked together using cryptography, making it extremely difficult to alter or tamper with the data. This immutability is a key feature that makes blockchain so secure. The decentralized nature of the ledger means that there is no single point of failure, making it more resilient to attacks. Furthermore, blockchain's transparency allows anyone to view the transactions that have been recorded, fostering trust and accountability. There are different types of blockchains, including public blockchains like Bitcoin and Ethereum, which are open to anyone, and private blockchains, which are permissioned and controlled by a single organization. Understanding the different types of blockchains and their respective use cases is crucial for making informed investment decisions. The technology is constantly evolving, with new innovations and applications emerging all the time.

Tips for Safe Blockchain Investment

Investing in blockchain can be exciting, but it's important to approach it with caution and a healthy dose of skepticism. One of the most important tips is to protect your private keys. Your private keys are like the passwords to your digital wallet, and if they fall into the wrong hands, your funds could be stolen. Store your private keys offline in a secure location, and never share them with anyone. Another important tip is to be wary of scams. The blockchain space is rife with scams, including pump-and-dump schemes, Ponzi schemes, and phishing attacks. Always do your research before investing in any project, and be skeptical of promises of guaranteed returns. It's also important to use secure exchanges and wallets. Choose reputable exchanges and wallets that have a strong security track record. Enable two-factor authentication whenever possible to add an extra layer of security. Finally, stay informed about the latest security threats and best practices.

Regulation and the Future of Blockchain

The regulatory landscape surrounding blockchain is still evolving, and there is a great deal of uncertainty about how governments will regulate the technology in the future. Some countries have embraced blockchain and are actively working to create a regulatory framework that fosters innovation. Other countries have taken a more cautious approach, and some have even banned certain blockchain-related activities. The lack of regulatory clarity can create challenges for businesses and investors. It's important to stay informed about the latest regulatory developments and to understand how they may impact your investments. Experts believe that regulation will play a crucial role in shaping the future of blockchain. Clear and consistent regulations can help to build trust and confidence in the technology, which will be essential for its widespread adoption. However, overly restrictive regulations could stifle innovation and prevent blockchain from reaching its full potential. Finding the right balance between regulation and innovation will be a key challenge for policymakers.

Fun Facts About Blockchain

Did you know that the first blockchain was created in 2008 by an anonymous person or group known as Satoshi Nakamoto? The purpose of this blockchain was to support the cryptocurrency Bitcoin. Another fun fact is that the largest block on the Bitcoin blockchain was over 2MB in size. Blocks typically hover around 1MB. The term "blockchain" wasn't actually used until after Bitcoin was released. Initially, it was referred to as a timechain.Blockchain technology isn't just limited to cryptocurrencies. It's being used in a wide variety of industries, including supply chain management, healthcare, and voting systems. The environmental impact of blockchain, particularly proof-of-work cryptocurrencies like Bitcoin, is a growing concern. However, there are many efforts underway to develop more energy-efficient blockchain technologies. Blockchain is a rapidly evolving technology, and there's still much to be discovered about its potential.

How to Get Started with Blockchain Investment

Getting started with blockchain investment can seem daunting, but it's actually quite accessible. The first step is to open an account with a reputable cryptocurrency exchange. There are many exchanges to choose from, so do your research and choose one that is secure and user-friendly. Once you have an account, you can purchase cryptocurrencies like Bitcoin or Ethereum. You can also invest in blockchain-related companies, such as those that develop blockchain software or provide blockchain services. Another option is to invest in blockchain-focused exchange-traded funds (ETFs). These ETFs provide diversified exposure to the blockchain market. It's important to remember that blockchain investment is inherently risky, so only invest what you can afford to lose. Start small and gradually increase your investments as you become more comfortable with the technology and the market.

What If Blockchain Fails?

While the potential benefits of blockchain are significant, it's important to consider the possibility that the technology may not live up to its hype. What if blockchain fails to achieve widespread adoption? What if it's replaced by a superior technology? What if it's rendered obsolete by quantum computing? These are all valid questions to consider. If blockchain fails, the consequences could be significant. Investors could lose money, businesses could waste resources, and the potential benefits of the technology could be lost. However, even if blockchain fails in its current form, the underlying principles of the technology – decentralization, transparency, and security – are likely to remain relevant. The lessons learned from blockchain could pave the way for future innovations. It's important to approach blockchain investment with a realistic perspective, acknowledging both the potential rewards and the potential risks.

Top 5 Benefits of Blockchain Investment: A Listicle

Here's a quick rundown of the top 5 benefits that experts predict will come from blockchain investment:

- Increased Security: Blockchain's cryptography and decentralized nature make it incredibly resistant to fraud and manipulation.

- Enhanced Transparency: The distributed ledger allows for greater accountability and trust between parties.

- Improved Efficiency: Blockchain automates processes, eliminates intermediaries, and reduces paperwork.

- New Investment Opportunities: Blockchain is creating new markets and opportunities across various industries.

- Democratized Access: Blockchain is making investment more accessible to individuals, regardless of their location or financial status.

These benefits are driving the growing interest in blockchain investment and are expected to shape the future of finance and beyond.

Question and Answer About What Experts Predict About Benefits of Blockchain Investment

Q: What are the main concerns experts have about blockchain investment?

A: While optimistic, experts worry about regulatory uncertainty, scalability issues, security vulnerabilities (despite blockchain's inherent security), and the potential for scams within the crypto space.

Q: Which industries are expected to benefit the most from blockchain investment?

A: Finance, supply chain management, healthcare, voting systems, and real estate are frequently cited as industries poised for significant disruption and benefit from blockchain technology.

Q: Is it too late to invest in blockchain?

A: Most experts believe that blockchain technology is still in its early stages of development and adoption. While some opportunities may have passed, many more are expected to emerge as the technology matures.

Q: What is the best way to mitigate the risks associated with blockchain investment?

A: Diversification is key. Invest in a variety of blockchain projects and asset classes. Conduct thorough research before investing in any project. Stay informed about the latest developments and regulations. And only invest what you can afford to lose.

Conclusion of What Experts Predict About Benefits of Blockchain Investment

The predictions surrounding blockchain investment paint a picture of a future shaped by increased security, transparency, and efficiency. While challenges remain, the potential for transformative change across various industries is undeniable. Staying informed, doing your due diligence, and approaching blockchain investment with a long-term perspective will be crucial for navigating this evolving landscape and capitalizing on the opportunities that lie ahead. The future, according to experts, is decentralized, and blockchain is poised to be a major player in that future.