Imagine a world where investment decisions in the volatile crypto market are driven by more than just hype and speculation. What if you could peer beneath the surface of flashy marketing and celebrity endorsements to truly understand the value, potential, and risks of a cryptocurrency or blockchain project? That’s the promise of fundamental analysis in the crypto world, and it's rapidly reshaping how savvy investors approach this exciting, yet often unpredictable, asset class.

The crypto landscape has been plagued by instances of projects that promised the moon but failed to deliver, leaving investors with significant losses. The over-reliance on superficial information and market sentiment has created an environment where sound investment strategies are often overlooked, and potential red flags are ignored.

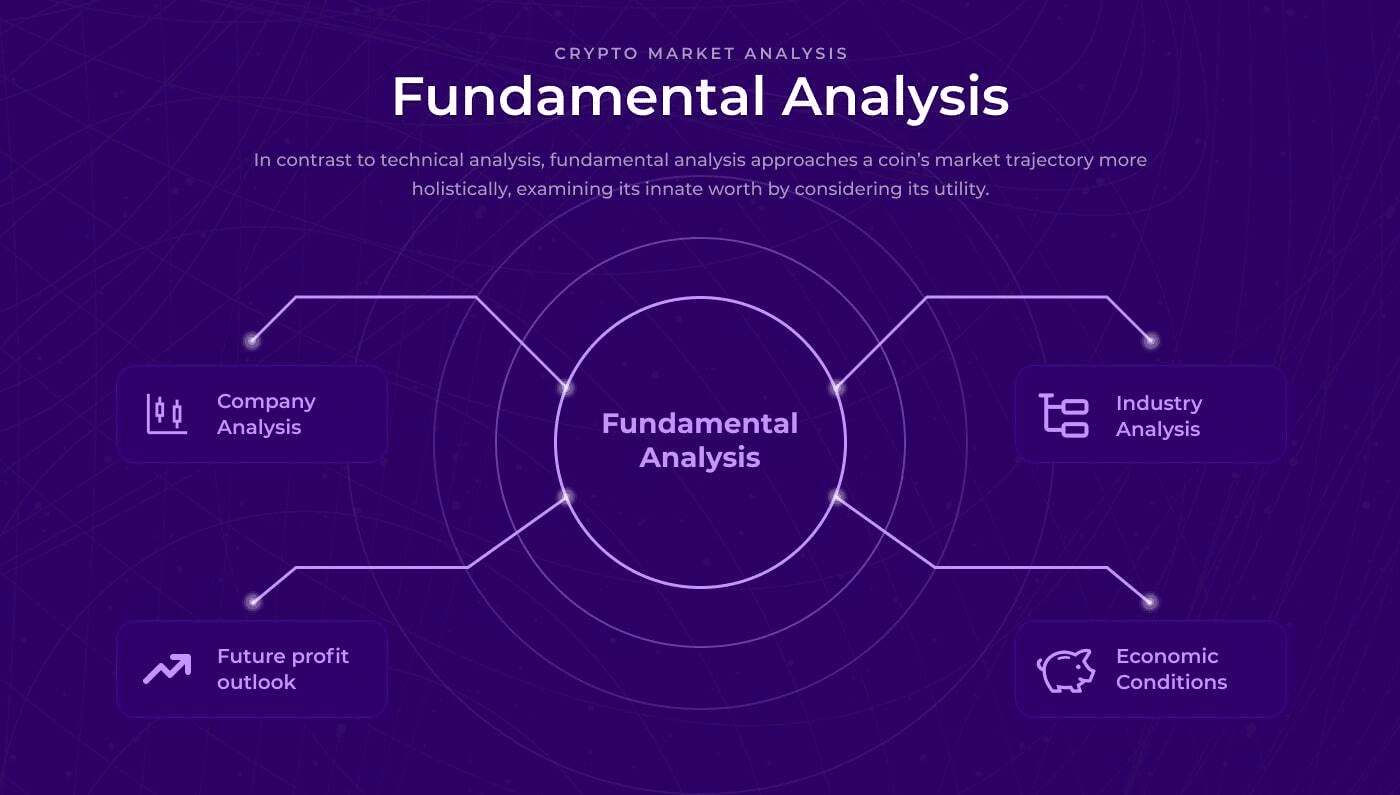

Fundamental analysis in the crypto world offers a powerful toolkit to navigate the complexities of this emerging market. By examining factors like a project’s underlying technology, tokenomics, team, community, and real-world adoption, investors can gain a more comprehensive and nuanced understanding of its intrinsic value. This empowers them to make more informed decisions, identify undervalued assets, and manage risk more effectively, ultimately contributing to a more mature and sustainable crypto ecosystem.

In essence, this is about moving beyond the noise and applying tried-and-true analytical methods to the world of digital assets. It entails digging into whitepapers, evaluating team expertise, scrutinizing token distribution models, and assessing real-world use cases. By embracing these principles, investors can mitigate risks, unearth hidden gems, and contribute to the evolution of a more rational and sustainable crypto market. Keywords: fundamental analysis, crypto, cryptocurrency, investment, blockchain, tokenomics, risk management, intrinsic value.

Understanding Crypto Project Whitepapers

Whitepapers, often complex and technical, are the foundational documents for understanding a crypto project. When I first encountered a whitepaper, it felt like trying to decipher a foreign language! The jargon, the technical diagrams, the lofty ambitions – it was overwhelming. But, I quickly realized that mastering the ability to dissect these documents was crucial to responsible crypto investing. It wasn't about understanding every single line of code, but rather grasping the core problem the project was trying to solve, the proposed solution, and the underlying technology powering it. A well-written whitepaper clearly articulates the project's vision, explains the token's utility, and outlines the roadmap for future development. Missing or vague sections can be a major red flag.

Fundamental analysis in the crypto world necessitates a thorough review of a project's whitepaper. It is the document that describes the project's purpose, technology, tokenomics, and roadmap. Investors must assess the clarity, feasibility, and originality of the ideas presented in the whitepaper. Is the problem well-defined, and is the proposed solution innovative and realistic? Are the tokenomics designed to incentivize participation and long-term value creation? A credible project will have a transparent and well-structured whitepaper that adequately addresses these concerns. By diligently analyzing whitepapers, investors can filter out projects with dubious foundations and focus on those with genuine potential.

Evaluating Tokenomics and Supply

Tokenomics, the economic model of a cryptocurrency, significantly impacts its long-term value.

The distribution of tokens, the mechanisms for burning or staking, and the incentives for holding or using the token all play a role in its potential success. A project with a poorly designed tokenomics model can face inflation, lack of liquidity, or concentration of wealth among a few holders, leading to price manipulation and instability.

When evaluating a token's supply, it's essential to consider both the total supply and the circulating supply. A large total supply with a limited circulating supply can create inflationary pressure in the future as more tokens are released into the market. Conversely, a small total supply with a large circulating supply can lead to scarcity and price appreciation, but also increased volatility. Investors should also scrutinize the token distribution, ensuring that a significant portion is not held by the project team or early investors, as this can create a risk of market dumping. By carefully analyzing tokenomics and supply dynamics, investors can assess the long-term sustainability and value potential of a cryptocurrency.

Assessing the Team and Community

The team behind a crypto project is just as important as the technology itself.

A strong team brings expertise, experience, and a proven track record to the table, increasing the likelihood of the project's success. Investors should research the team members, looking at their backgrounds, previous projects, and credibility within the industry. Are they transparent and accessible, or do they operate in secrecy? Do they have the technical skills, business acumen, and marketing expertise to execute their vision?

The community surrounding a crypto project is also a crucial indicator of its potential. A vibrant and engaged community can provide valuable feedback, support, and advocacy, helping to drive adoption and growth. Investors should monitor the project's social media channels, online forums, and developer communities to gauge the level of interest and engagement. Are community members actively involved in discussions, or are they merely passive observers? Is the community well-managed and inclusive, or is it plagued by negativity and infighting? A strong and supportive community can be a significant asset for a crypto project, while a weak or toxic community can be a major liability.

Analyzing Real-World Adoption and Use Cases

The ultimate success of a cryptocurrency hinges on its real-world adoption and utility.

A project that solves a real-world problem and provides tangible value to users is more likely to thrive in the long run. Investors should assess the project's target market, the size of the potential market, and the competitive landscape. Is there a genuine need for the product or service being offered, or is it simply a solution in search of a problem?

The use cases for a cryptocurrency can range from payments and remittances to decentralized finance (De Fi) and supply chain management. Investors should evaluate the feasibility and scalability of these use cases. Can the technology handle a large volume of transactions, and is it cost-effective and user-friendly? Are there any regulatory hurdles or legal risks that could hinder adoption?

Furthermore, investors should examine the project's partnerships and integrations. Are they working with established businesses or organizations, and are they actively promoting their technology to potential users? Real-world adoption is the ultimate validation of a crypto project's value proposition, and investors should prioritize projects that demonstrate a clear path to widespread adoption.

Using Financial Metrics in Crypto

While traditional financial metrics like revenue, earnings, and cash flow may not always be directly applicable to crypto projects, there are alternative metrics that can provide valuable insights.

For example, the "transaction volume" of a blockchain network can be used as a proxy for revenue, indicating the level of activity and demand for the network's services. The "number of active addresses" can be used as a proxy for user base, indicating the size and engagement of the community.

Another important metric is the "market capitalization" of a cryptocurrency, which represents the total value of all outstanding tokens. This can be compared to the market capitalization of other cryptocurrencies in the same sector to assess relative valuation.

Investors should also pay attention to metrics like "staking rewards" and "governance rights," which can provide additional incentives for holding and participating in a project. By adapting and applying financial metrics to the unique characteristics of crypto projects, investors can gain a more objective and data-driven understanding of their potential.

Essential Tools for Crypto Fundamental Analysis

Effective fundamental analysis requires access to reliable data and tools.

Websites like Coin Market Cap and Coin Gecko provide comprehensive information on cryptocurrencies, including price charts, market capitalization, trading volume, and circulating supply. Blockchain explorers like Etherscan and Bsc Scan allow investors to track transactions, analyze network activity, and monitor smart contract interactions.

Social media analytics tools can be used to gauge public sentiment and track community engagement. Developer tools like Git Hub provide insights into the project's code repository, allowing investors to assess the level of development activity and the quality of the code.

Furthermore, there are specialized platforms that offer fundamental analysis reports and ratings for cryptocurrencies. These platforms typically employ a team of analysts who conduct in-depth research on crypto projects, providing investors with objective and unbiased assessments of their potential. By leveraging these essential tools, investors can streamline their research process and gain a competitive edge in the crypto market.

Risks to Be Aware of During Crypto Fundamental Analysis

While fundamental analysis can significantly reduce investment risk in the crypto market, it's essential to be aware of the inherent risks involved.

The crypto market is highly volatile, and even fundamentally sound projects can experience significant price fluctuations due to market sentiment, regulatory changes, or unforeseen events. Furthermore, the lack of regulation in the crypto market can create opportunities for fraud and manipulation.

It's crucial to be skeptical and do your own research, rather than relying solely on the opinions of others. Beware of projects that make unrealistic promises or guarantee high returns. Be wary of projects that lack transparency or have a history of security breaches. Diversify your portfolio to mitigate risk, and never invest more than you can afford to lose.

Fundamental analysis is not a foolproof method for predicting the future, but it can help you make more informed decisions and avoid costly mistakes. By understanding the risks and limitations of fundamental analysis, you can navigate the crypto market with greater confidence and increase your chances of success.

Fun Facts About Fundamental Analysis in Crypto

Did you know that some of the earliest forms of fundamental analysis in crypto involved analyzing Bitcoin's hashrate to gauge network security? Or that some investors use on-chain data to track the movement of large amounts of cryptocurrency, looking for signals of whale activity? The application of fundamental analysis in the crypto world is constantly evolving as the market matures and new data sources become available. It's a dynamic field that requires continuous learning and adaptation. As crypto continues to disrupt traditional finance, the principles of fundamental analysis will become even more critical for navigating this exciting and rapidly changing landscape. These analytical methods help investors distinguish between fleeting hype and lasting value. It also enables them to contribute to a more informed and sustainable crypto ecosystem.

How to Begin with Crypto Fundamental Analysis

Getting started with crypto fundamental analysis doesn't require a Ph D in finance or computer science. It begins with a willingness to learn and a commitment to doing your own research. Start by reading whitepapers and exploring the websites of crypto projects that interest you. Follow reputable analysts and researchers on social media and engage in discussions with other investors.

Use the tools mentioned earlier to track market data and analyze blockchain activity. Gradually, you'll develop a deeper understanding of the key metrics and indicators that drive the crypto market. Don't be afraid to ask questions and seek out mentorship from more experienced investors. The crypto community is generally welcoming and supportive, and there are plenty of resources available to help you on your journey. With time and practice, you can become a proficient fundamental analyst and make more informed investment decisions in the exciting world of crypto. Remember, the journey of a thousand miles begins with a single step.

What if Everyone Used Fundamental Analysis in Crypto?

Imagine a crypto market where fundamental analysis was the norm, not the exception. The impact would be transformative. Projects with strong fundamentals would attract more investment, while those with weak fundamentals would struggle to gain traction. This would incentivize crypto projects to focus on building real value and solving real-world problems, rather than relying on hype and speculation. The market would become more efficient, with prices reflecting the true underlying value of assets. Volatility would decrease as investors became more rational and less prone to panic selling or FOMO buying. The crypto ecosystem would become more sustainable, with a greater focus on long-term growth and innovation.

While it's unlikely that everyone will embrace fundamental analysis, the more investors who do, the more mature and resilient the crypto market will become. By promoting a more informed and rational approach to investing, fundamental analysis can help to unlock the full potential of crypto and contribute to a more inclusive and prosperous financial future.

Listicle of Fundamental Analysis Points for Crypto

Here's a quick listicle summarizing key aspects of fundamental analysis in crypto:

1.Whitepaper Deep Dive: Thoroughly analyze the project's whitepaper to understand its purpose, technology, and roadmap.

2.Tokenomics Scrutiny: Evaluate the token's economic model, including supply, distribution, and incentives.

3.Team Assessment: Research the team members' backgrounds, experience, and credibility.

4.Community Engagement: Monitor the project's social media channels and online forums to gauge community interest and support.

5.Real-World Adoption: Analyze the project's use cases, partnerships, and integrations to assess its real-world potential.

6.Financial Metrics Adaptation: Adapt traditional financial metrics to the unique characteristics of crypto projects.

7.Tool Utilization: Leverage essential tools for tracking market data, analyzing blockchain activity, and assessing developer activity.

8.Risk Awareness: Be aware of the inherent risks involved in crypto investing and diversify your portfolio accordingly.

Question and Answer about Fundamental Analysis Crypto

Q: Is fundamental analysis always accurate in predicting crypto prices?

A: No, fundamental analysis is not a crystal ball. The crypto market is inherently volatile and unpredictable, and external factors can significantly impact prices. However, fundamental analysis can help you make more informed decisions and reduce your risk of investing in overhyped or fraudulent projects.

Q: What are some common mistakes to avoid when doing fundamental analysis in crypto?

A: Common mistakes include relying solely on social media sentiment, ignoring red flags in the whitepaper, failing to understand the tokenomics, and investing more than you can afford to lose.

Q: How often should I re-evaluate my crypto investments based on fundamental analysis?

A: The crypto market is constantly evolving, so it's essential to re-evaluate your investments regularly. At a minimum, you should review your portfolio every quarter and make adjustments as needed.

Q: Where can I find reliable resources for learning more about fundamental analysis in crypto?

A: There are many reputable websites, blogs, and podcasts that cover fundamental analysis in crypto. Some popular resources include Coin Market Cap, Coin Gecko, Messari, and Delphi Digital. Additionally, consider following reputable analysts and researchers on social media.

Conclusion of How Fundamental Analysis Crypto

The shift towards fundamental analysis in the cryptocurrency realm marks a significant step towards a more mature and rational market. By moving beyond speculative hype and focusing on tangible value drivers such as technology, team, tokenomics, and real-world adoption, investors can make more informed decisions, mitigate risks, and contribute to the long-term sustainability of the crypto ecosystem. While fundamental analysis is not a foolproof method, it provides a framework for understanding the intrinsic value of digital assets and identifying projects with genuine potential. As the crypto landscape continues to evolve, the principles of fundamental analysis will become increasingly critical for navigating its complexities and unlocking its transformative power.